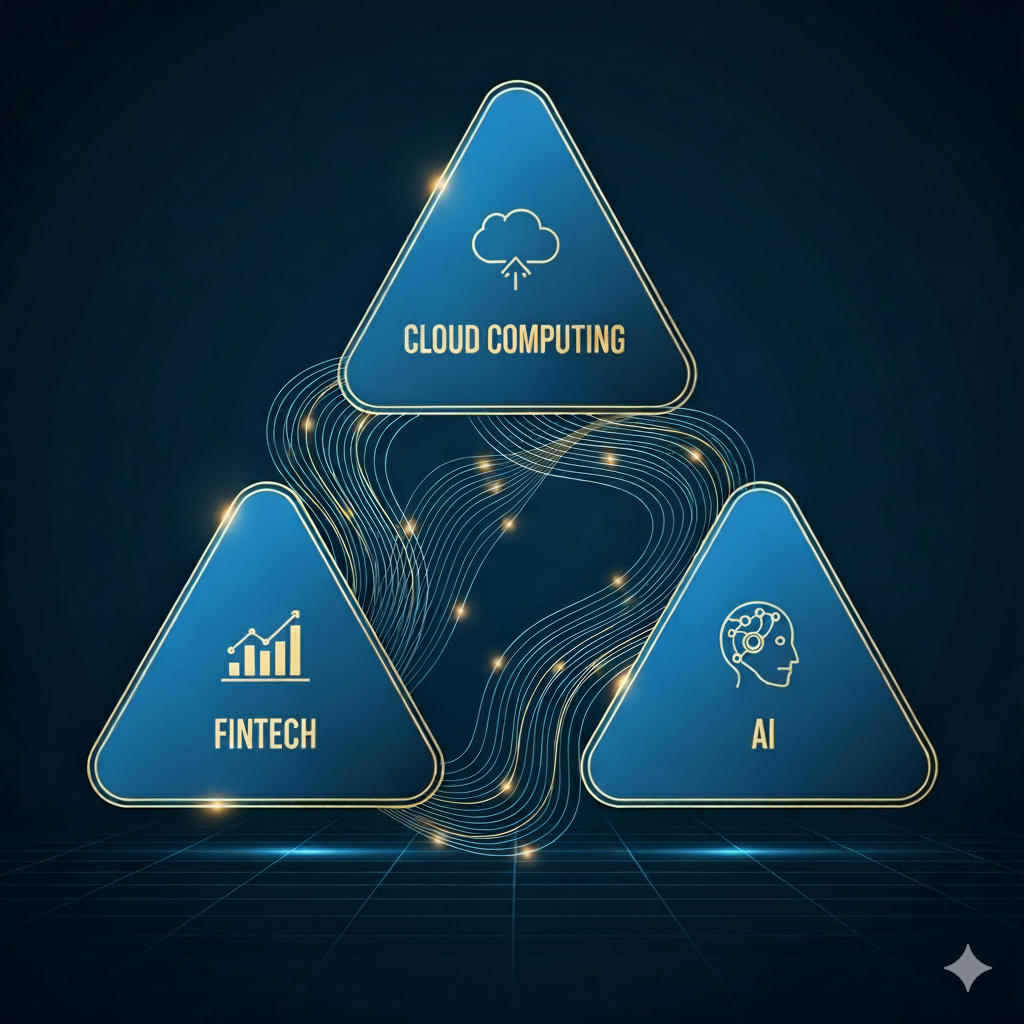

2025 is shaping up to be a pivotal year for technology. The initial hype of AI has matured, transforming from a promise into a foundational layer that’s reshaping entire industries. But this isn’t just about one technology; it’s about a powerful convergence.

The real story of the 2025 tech boom is a “trifecta” of three dominant forces: the explosive growth of cloud computing, the resurgence of FinTech, and the quiet, strategic moves of Apple’s new, unreleased AI which is now coming to light. Together, they are creating a new engine for innovation, efficiency, and profit.

Here’s how these three trends are not just co-existing, but are actively amplifying each other to drive the next wave of technological progress.

1. The Cloud: The $900 Billion Engine of AI

Artificial intelligence doesn’t run on thin air. It runs on data centers. The insatiable demand for computing power needed to train and run massive AI models has turned cloud computing into the most critical infrastructure play of the decade. Analysts project the cloud market to surpass $900 billion this year, with much of that growth directly tied to AI.

- Hyperscale Power: Companies like Google, Amazon, and Microsoft are locked in a race to build bigger, more powerful data centers to meet the demand for AI workloads. This isn’t just about storage anymore; it’s about providing the specialized chips (like NVIDIA’s GPUs) and scalable environments that make AI possible.

- A “Pay-Per-Drink” Model: The cloud allows companies of all sizes, from a one-person startup to a global enterprise, to access powerful AI without massive upfront investment. This democratizes AI, enabling smaller players to innovate at a pace that was previously impossible.

The cloud is the invisible, yet essential, foundation upon which the entire AI revolution is being built.

2. FinTech’s AI-Powered Resurgence

FinTech the sector that combines finance and technology is making a major comeback. After a period of cooling off, AI is breathing new life into the industry, creating opportunities for both traditional institutions and new-age disruptors.

- Embedded Finance: AI is enabling financial services to be seamlessly integrated into everyday apps and platforms. Think about a shopping app that offers a personalized “buy now, pay later” option powered by AI-driven credit scoring. The embedded finance market is projected to reach over $250 billion in the next few years.

- Hyper-Personalization: AI is transforming customer experience in finance. It can analyze user behavior to offer personalized investment advice, flag fraudulent transactions in real time, and automate compliance checks. This makes financial services faster, more secure, and more tailored to the individual.

FinTech is no longer just about digital payments; it’s about using AI to create a more efficient, intelligent, and accessible financial system for everyone.

3. Apple’s Private AI: The Next Frontier for Siri

While competitors have rushed to market with flashy consumer-facing chatbots, Apple has been quietly building an AI foundation with its signature “privacy-first” approach. This strategy is best seen in its new, secretive AI bot that is being tested as an internal tool for its retail employees.

The new AI chatbot is designed to assist Apple Store staff by providing instant access to product details and sales strategies. The tool allows employees to ask open-ended questions about product features and receive tailored responses, improving both training and customer interactions.

- On-Device Processing: What makes this new tool a game-changer is its primary focus on on-device processing. This means it handles most of its data and queries on the device itself, reducing the need for cloud-based servers and keeping data private. This is a clear signal of Apple’s long-term strategy: embed powerful, privacy-focused AI directly into its ecosystem.

- The Future of Siri? While this new chatbot is currently an internal tool, many in the industry believe its underlying technology will form the basis for a more powerful, capable, and privacy-conscious Siri. This could finally transform Apple’s voice assistant from a simple command-and-control tool into a true, intelligent co-pilot, without compromising user privacy.

Apple’s deliberate, cautious approach is not a sign of being behind, but rather a hint at a polished, integrated AI that will redefine user expectations the way the iPhone did for smartphones.

The Bottom Line: Prepare for the Convergence

The biggest companies are not just investing in one of these areas; they are investing in the convergence of all three. Cloud provides the foundation, AI provides the intelligence, and FinTech provides the real-world application with a clear path to monetization.

The future isn’t about AI alone. It’s about AI, cloud, and FinTech working together in a powerful trifecta. The companies and individuals who understand this convergence will be the ones that lead the next wave of innovation.

What do you think is the most exciting piece of this AI trifecta? Share your thoughts below!

Disclaimer: This blog post was generated with the help of artificial intelligence. Readers are encouraged to verify facts independently.